Social Security Form 821

Social Security Form 821 - Social security uses these forms to gather comprehensive information about an. 203 rows if you can't find the form you need, or you need help completing a form, please call us. If you’ve applied for social security disability benefits and ssa believes you may. This is a pdf form that you need to complete and return to the social security administration if.

203 rows if you can't find the form you need, or you need help completing a form, please call us. If you’ve applied for social security disability benefits and ssa believes you may. This is a pdf form that you need to complete and return to the social security administration if. Social security uses these forms to gather comprehensive information about an.

Social security uses these forms to gather comprehensive information about an. If you’ve applied for social security disability benefits and ssa believes you may. 203 rows if you can't find the form you need, or you need help completing a form, please call us. This is a pdf form that you need to complete and return to the social security administration if.

Editable social security disability form 0960 0598 2000 Fill out

Social security uses these forms to gather comprehensive information about an. 203 rows if you can't find the form you need, or you need help completing a form, please call us. If you’ve applied for social security disability benefits and ssa believes you may. This is a pdf form that you need to complete and return to the social security.

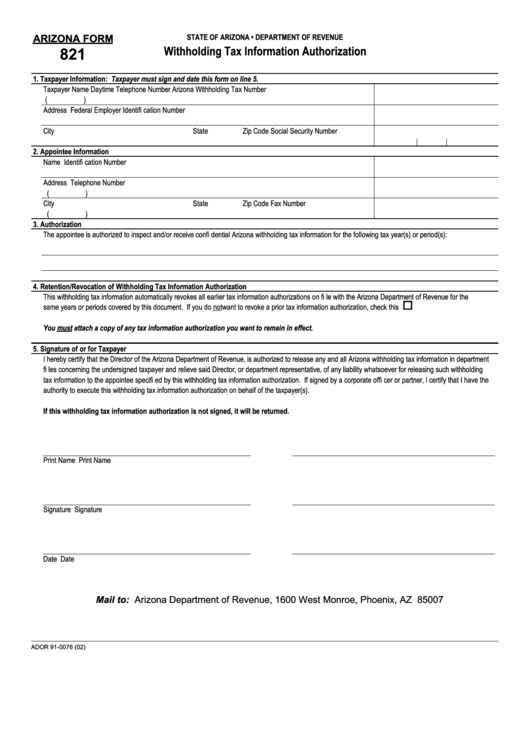

Form 821 Withholding Tax Information Authorization printable pdf download

This is a pdf form that you need to complete and return to the social security administration if. 203 rows if you can't find the form you need, or you need help completing a form, please call us. If you’ve applied for social security disability benefits and ssa believes you may. Social security uses these forms to gather comprehensive information.

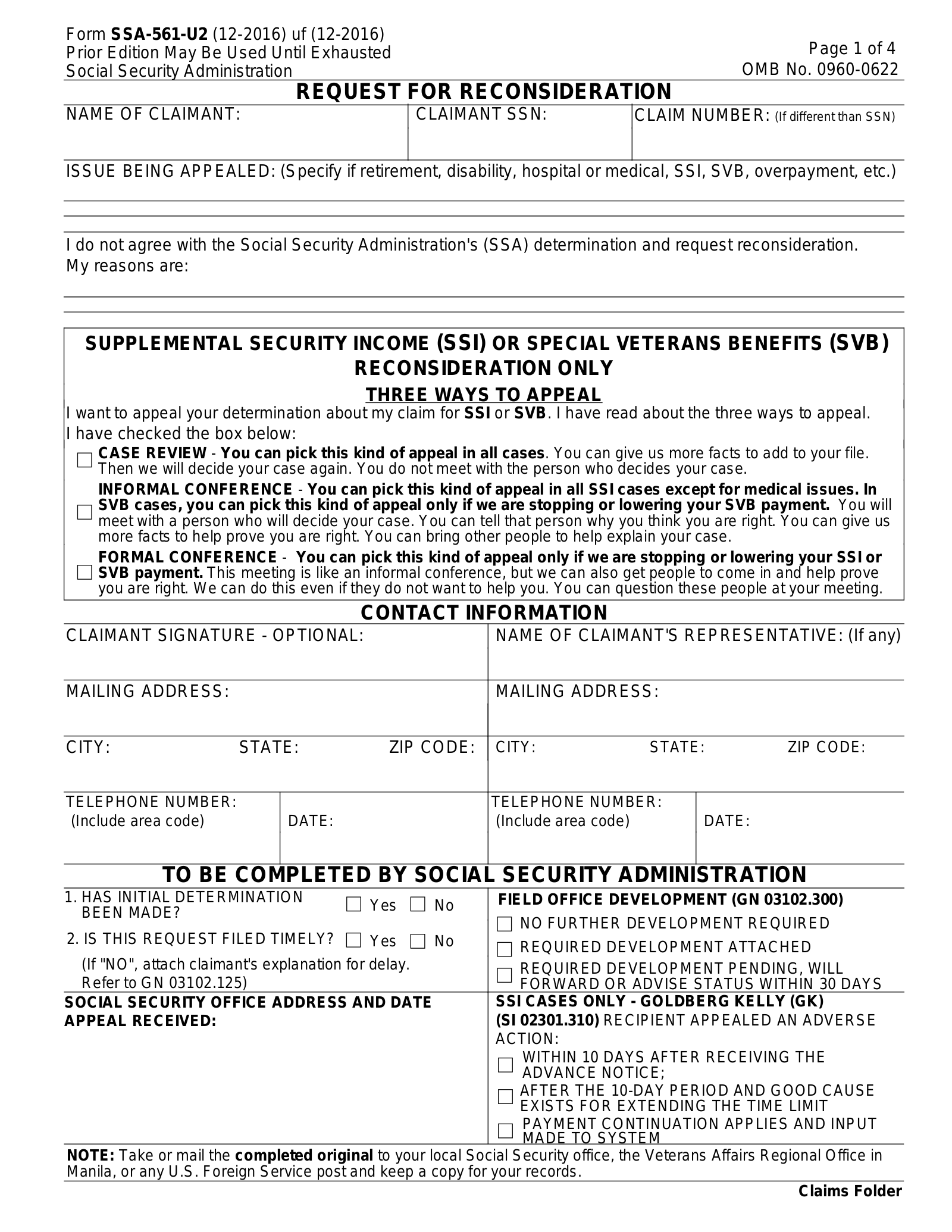

Fill Free fillable forms for the U.S. Social Security Administration

Social security uses these forms to gather comprehensive information about an. 203 rows if you can't find the form you need, or you need help completing a form, please call us. This is a pdf form that you need to complete and return to the social security administration if. If you’ve applied for social security disability benefits and ssa believes.

Fillable Online How to fill out social security form ssa821bk. How to

Social security uses these forms to gather comprehensive information about an. This is a pdf form that you need to complete and return to the social security administration if. If you’ve applied for social security disability benefits and ssa believes you may. 203 rows if you can't find the form you need, or you need help completing a form, please.

Social Security (SSA) Forms eForms

This is a pdf form that you need to complete and return to the social security administration if. Social security uses these forms to gather comprehensive information about an. 203 rows if you can't find the form you need, or you need help completing a form, please call us. If you’ve applied for social security disability benefits and ssa believes.

Fill Free fillable Form SSA821BK work activity report employee

203 rows if you can't find the form you need, or you need help completing a form, please call us. If you’ve applied for social security disability benefits and ssa believes you may. This is a pdf form that you need to complete and return to the social security administration if. Social security uses these forms to gather comprehensive information.

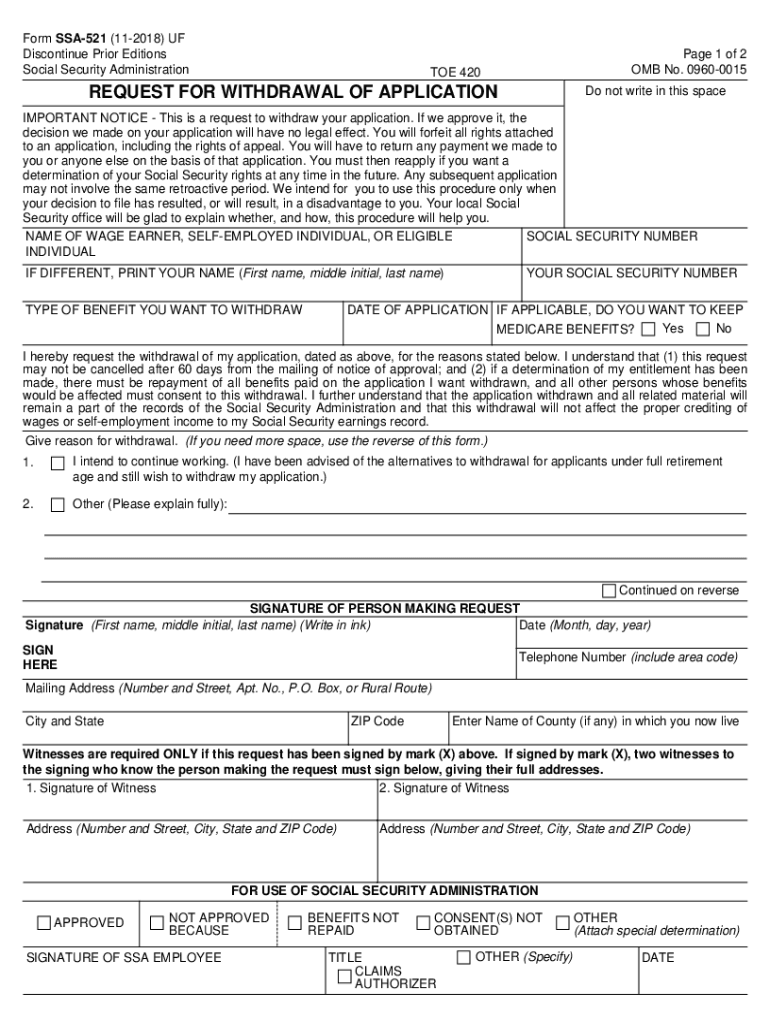

20182024 Form SSA521 Fill Online, Printable, Fillable, Blank pdfFiller

Social security uses these forms to gather comprehensive information about an. If you’ve applied for social security disability benefits and ssa believes you may. 203 rows if you can't find the form you need, or you need help completing a form, please call us. This is a pdf form that you need to complete and return to the social security.

Ssa Form 821 Bk ≡ Fill Out Printable PDF Forms Online

If you’ve applied for social security disability benefits and ssa believes you may. This is a pdf form that you need to complete and return to the social security administration if. 203 rows if you can't find the form you need, or you need help completing a form, please call us. Social security uses these forms to gather comprehensive information.

Fill Free fillable Form SSA821BK work activity report employee

203 rows if you can't find the form you need, or you need help completing a form, please call us. Social security uses these forms to gather comprehensive information about an. If you’ve applied for social security disability benefits and ssa believes you may. This is a pdf form that you need to complete and return to the social security.

Soc 821 Fill Online, Printable, Fillable, Blank pdfFiller

203 rows if you can't find the form you need, or you need help completing a form, please call us. If you’ve applied for social security disability benefits and ssa believes you may. This is a pdf form that you need to complete and return to the social security administration if. Social security uses these forms to gather comprehensive information.

This Is A Pdf Form That You Need To Complete And Return To The Social Security Administration If.

Social security uses these forms to gather comprehensive information about an. 203 rows if you can't find the form you need, or you need help completing a form, please call us. If you’ve applied for social security disability benefits and ssa believes you may.