Lien Discharge

Lien Discharge - An irs tax lien discharge removes the federal government’s lien from a particular piece of property and allows taxpayers to transfer. Subject to such regulations as the secretary may prescribe, the secretary may issue a certificate of discharge of any part of the property subject to. If you are in tax debt, you can request that the irs remove its lien from your property so that you can sell it and use the proceeds to pay off your. Submit your application at least 45 days before the transaction date the certificate of discharge is needed to allow sufficient time for the irs to.

Subject to such regulations as the secretary may prescribe, the secretary may issue a certificate of discharge of any part of the property subject to. If you are in tax debt, you can request that the irs remove its lien from your property so that you can sell it and use the proceeds to pay off your. Submit your application at least 45 days before the transaction date the certificate of discharge is needed to allow sufficient time for the irs to. An irs tax lien discharge removes the federal government’s lien from a particular piece of property and allows taxpayers to transfer.

If you are in tax debt, you can request that the irs remove its lien from your property so that you can sell it and use the proceeds to pay off your. Submit your application at least 45 days before the transaction date the certificate of discharge is needed to allow sufficient time for the irs to. Subject to such regulations as the secretary may prescribe, the secretary may issue a certificate of discharge of any part of the property subject to. An irs tax lien discharge removes the federal government’s lien from a particular piece of property and allows taxpayers to transfer.

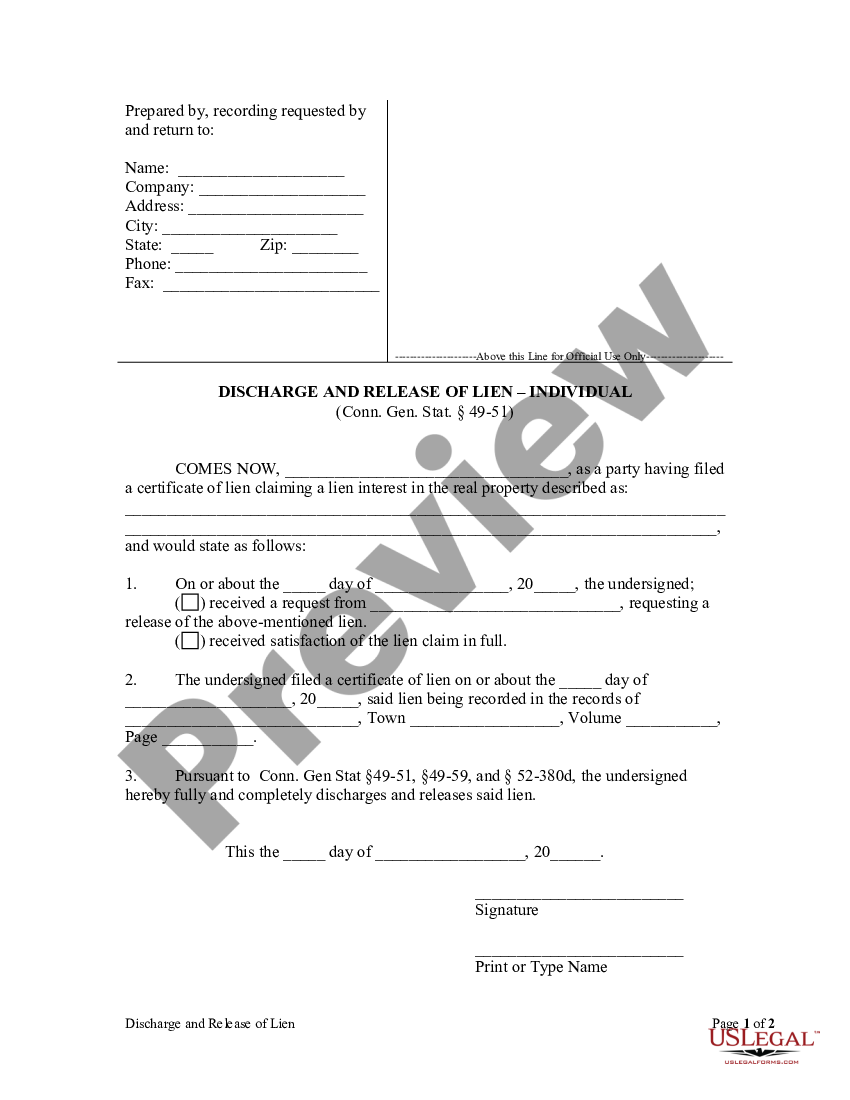

Stamford Connecticut Discharge and Release of Lien by Individual

If you are in tax debt, you can request that the irs remove its lien from your property so that you can sell it and use the proceeds to pay off your. An irs tax lien discharge removes the federal government’s lien from a particular piece of property and allows taxpayers to transfer. Submit your application at least 45 days.

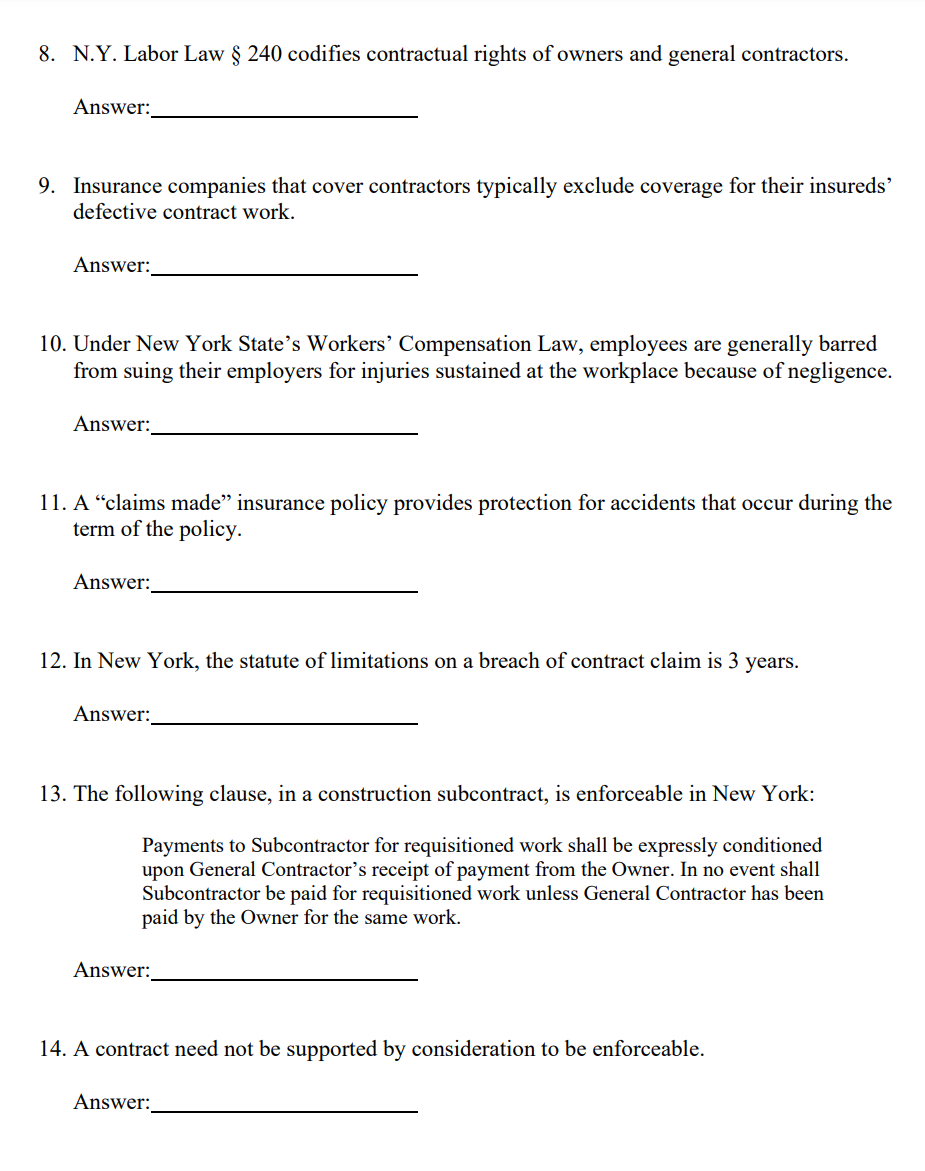

Solved 1. Filing a lien discharge bond with the court will

Submit your application at least 45 days before the transaction date the certificate of discharge is needed to allow sufficient time for the irs to. If you are in tax debt, you can request that the irs remove its lien from your property so that you can sell it and use the proceeds to pay off your. An irs tax.

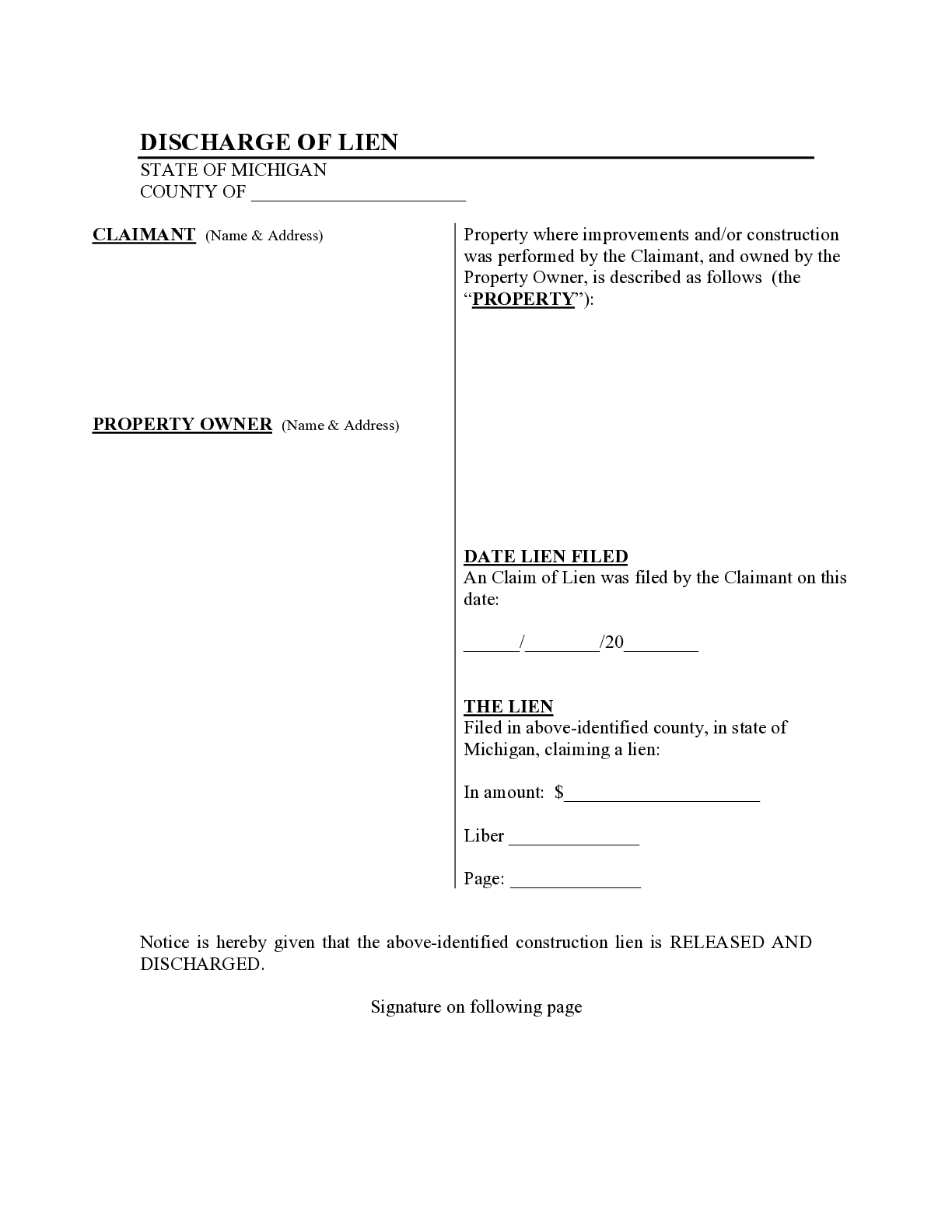

Michigan Discharge of Lien Form Free Downloadable Template

Subject to such regulations as the secretary may prescribe, the secretary may issue a certificate of discharge of any part of the property subject to. If you are in tax debt, you can request that the irs remove its lien from your property so that you can sell it and use the proceeds to pay off your. An irs tax.

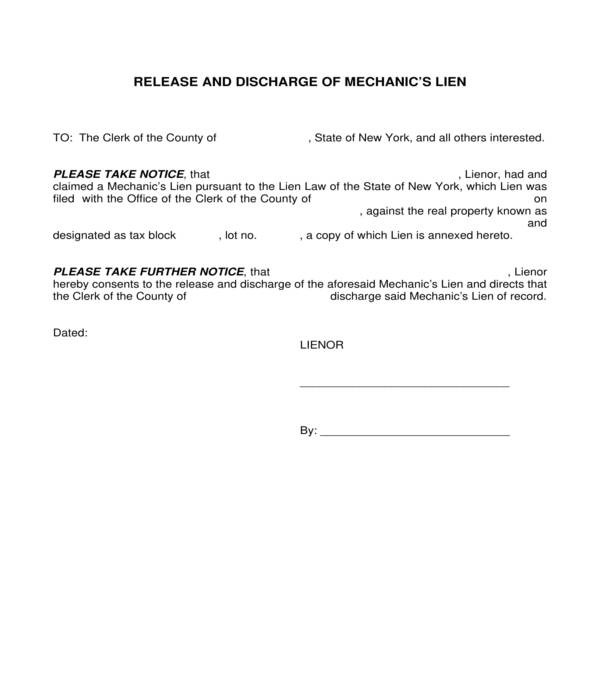

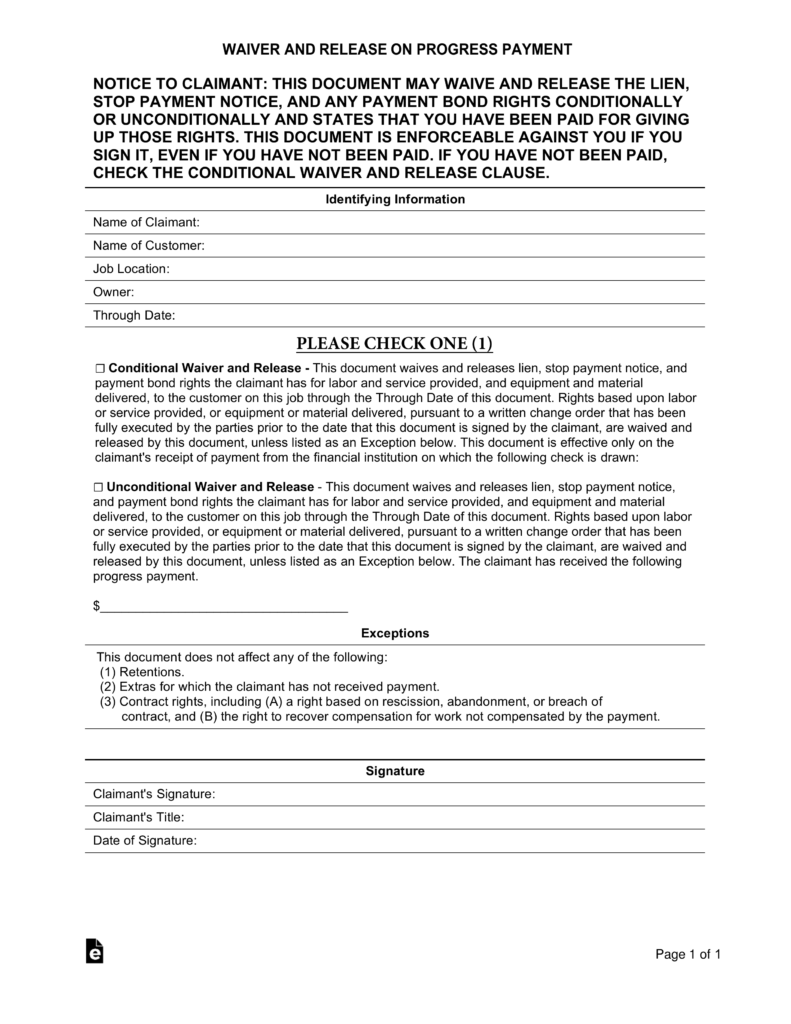

FREE 5+ Contractor's Mechanic's Lien Release Forms in PDF

An irs tax lien discharge removes the federal government’s lien from a particular piece of property and allows taxpayers to transfer. If you are in tax debt, you can request that the irs remove its lien from your property so that you can sell it and use the proceeds to pay off your. Subject to such regulations as the secretary.

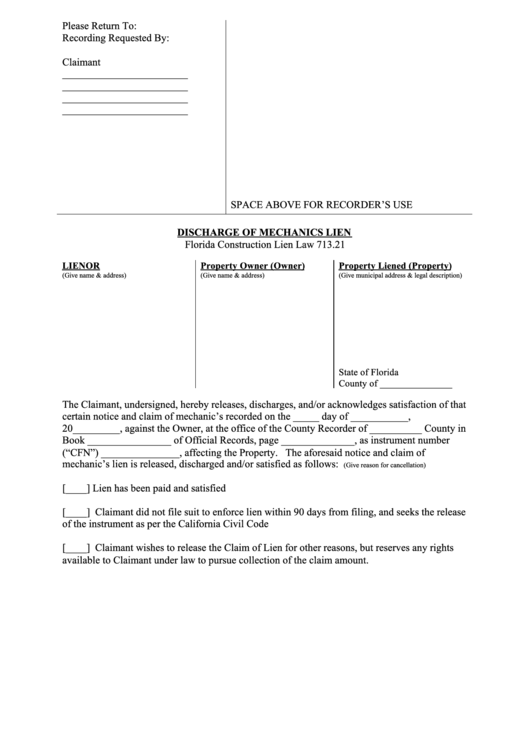

Discharge Of Mechanics Lien printable pdf download

Subject to such regulations as the secretary may prescribe, the secretary may issue a certificate of discharge of any part of the property subject to. If you are in tax debt, you can request that the irs remove its lien from your property so that you can sell it and use the proceeds to pay off your. Submit your application.

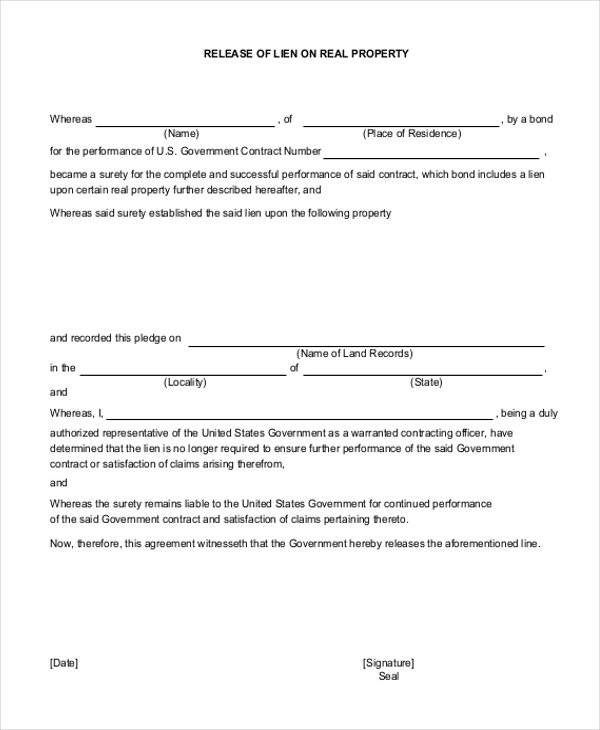

Release and Discharge Mechanics' Lien Form Free Download

If you are in tax debt, you can request that the irs remove its lien from your property so that you can sell it and use the proceeds to pay off your. An irs tax lien discharge removes the federal government’s lien from a particular piece of property and allows taxpayers to transfer. Subject to such regulations as the secretary.

Free Lien Release Form Template

Subject to such regulations as the secretary may prescribe, the secretary may issue a certificate of discharge of any part of the property subject to. An irs tax lien discharge removes the federal government’s lien from a particular piece of property and allows taxpayers to transfer. Submit your application at least 45 days before the transaction date the certificate of.

FREE 11+ Sample Lien Release Forms in PDF MS Word

Subject to such regulations as the secretary may prescribe, the secretary may issue a certificate of discharge of any part of the property subject to. If you are in tax debt, you can request that the irs remove its lien from your property so that you can sell it and use the proceeds to pay off your. Submit your application.

Lien Waiver Template Fill Online, Printable, Fillable, Blank pdfFiller

An irs tax lien discharge removes the federal government’s lien from a particular piece of property and allows taxpayers to transfer. Submit your application at least 45 days before the transaction date the certificate of discharge is needed to allow sufficient time for the irs to. Subject to such regulations as the secretary may prescribe, the secretary may issue a.

LIEN DISCHARGE WITHOUT FULL RESTITUTION_Page_1 Doug Zandstra, CPA

Submit your application at least 45 days before the transaction date the certificate of discharge is needed to allow sufficient time for the irs to. If you are in tax debt, you can request that the irs remove its lien from your property so that you can sell it and use the proceeds to pay off your. An irs tax.

Subject To Such Regulations As The Secretary May Prescribe, The Secretary May Issue A Certificate Of Discharge Of Any Part Of The Property Subject To.

If you are in tax debt, you can request that the irs remove its lien from your property so that you can sell it and use the proceeds to pay off your. An irs tax lien discharge removes the federal government’s lien from a particular piece of property and allows taxpayers to transfer. Submit your application at least 45 days before the transaction date the certificate of discharge is needed to allow sufficient time for the irs to.