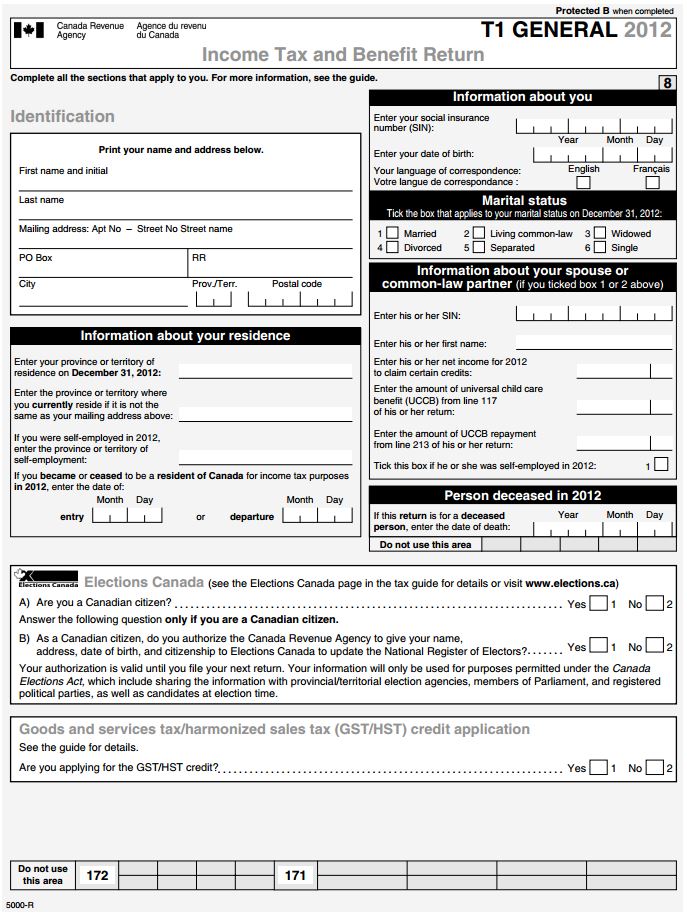

Canada Tax Return Form

Canada Tax Return Form - What is a t1 general income tax form? Turbotax® provides all the tax forms you need, based on your tax situation. This document provides a comprehensive list of key federal tax forms for. The primary document you need to file. As an employee, you complete this form if you have a new employer or payer and. You can get an income tax package online or by mail.

This document provides a comprehensive list of key federal tax forms for. The primary document you need to file. You can get an income tax package online or by mail. Turbotax® provides all the tax forms you need, based on your tax situation. What is a t1 general income tax form? As an employee, you complete this form if you have a new employer or payer and.

You can get an income tax package online or by mail. This document provides a comprehensive list of key federal tax forms for. What is a t1 general income tax form? As an employee, you complete this form if you have a new employer or payer and. Turbotax® provides all the tax forms you need, based on your tax situation. The primary document you need to file.

Canada Tax Return Deadline 2024 Adi Felecia

You can get an income tax package online or by mail. This document provides a comprehensive list of key federal tax forms for. As an employee, you complete this form if you have a new employer or payer and. What is a t1 general income tax form? The primary document you need to file.

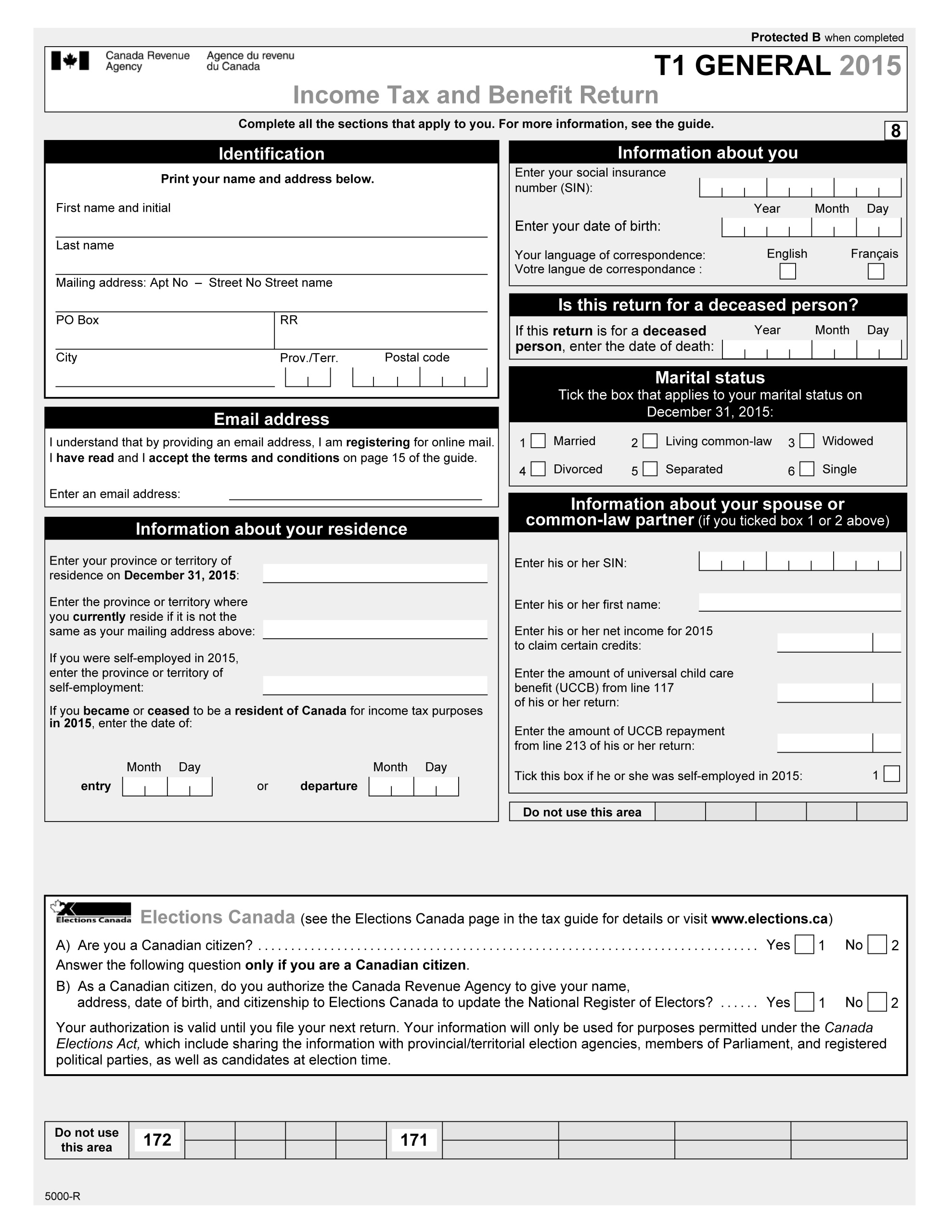

Free Alberta Canada Tax and Benefit Return Form (T1 General

What is a t1 general income tax form? The primary document you need to file. This document provides a comprehensive list of key federal tax forms for. Turbotax® provides all the tax forms you need, based on your tax situation. You can get an income tax package online or by mail.

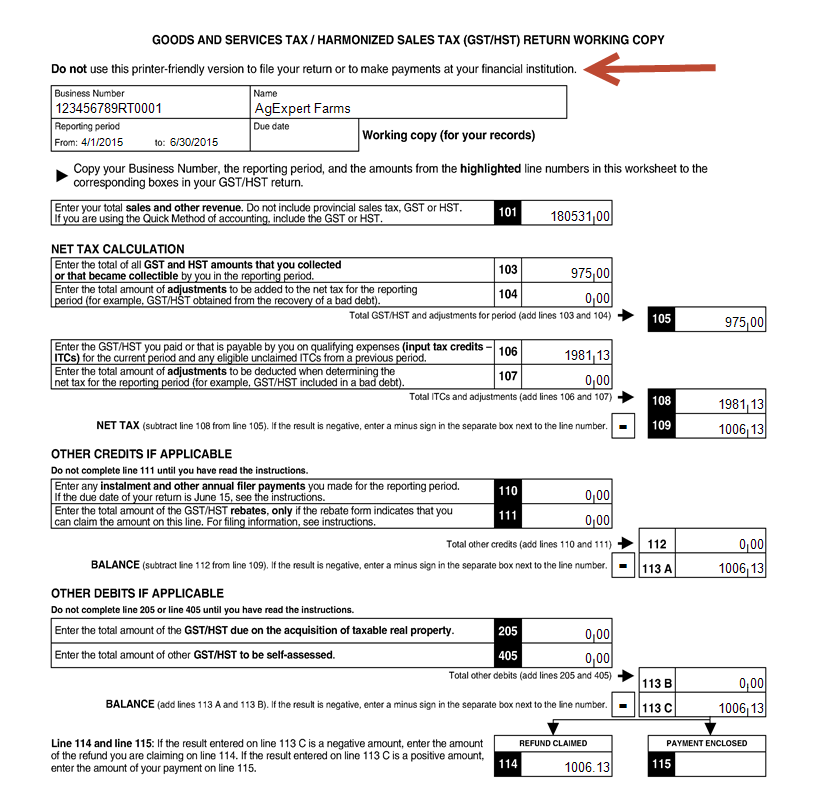

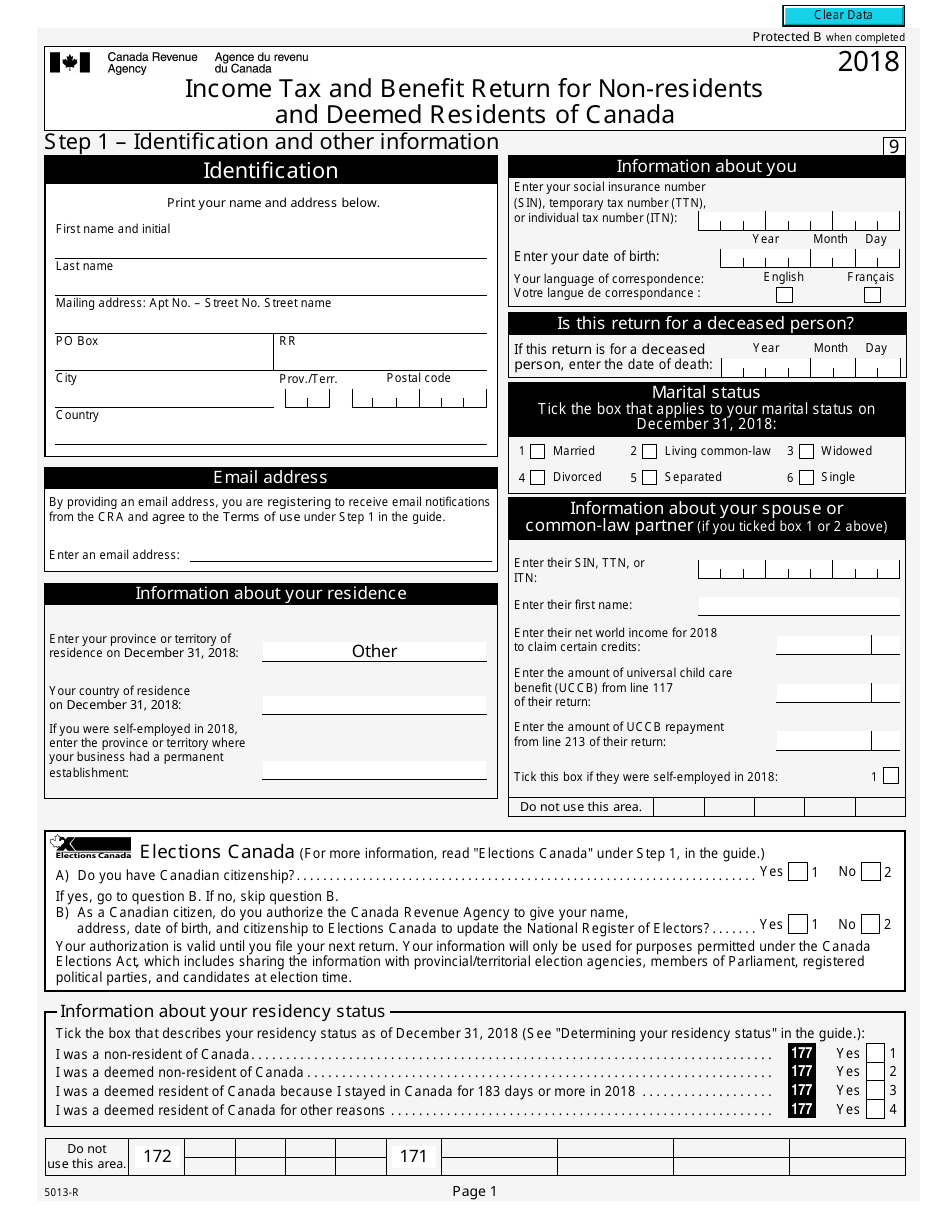

Online Tax Canada Online Tax Return

The primary document you need to file. Turbotax® provides all the tax forms you need, based on your tax situation. You can get an income tax package online or by mail. What is a t1 general income tax form? As an employee, you complete this form if you have a new employer or payer and.

Completing a basic tax return Learn about your taxes Canada.ca

What is a t1 general income tax form? As an employee, you complete this form if you have a new employer or payer and. This document provides a comprehensive list of key federal tax forms for. You can get an income tax package online or by mail. The primary document you need to file.

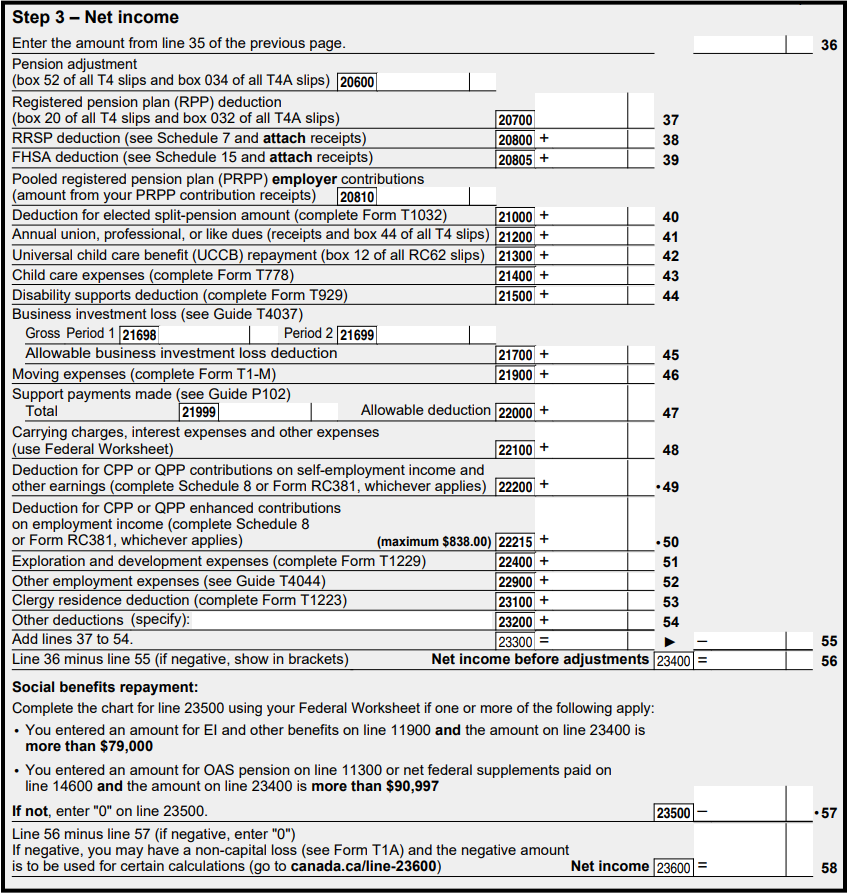

20152024 Form Canada T1 General Fill Online, Printable, Fillable

Turbotax® provides all the tax forms you need, based on your tax situation. As an employee, you complete this form if you have a new employer or payer and. You can get an income tax package online or by mail. The primary document you need to file. This document provides a comprehensive list of key federal tax forms for.

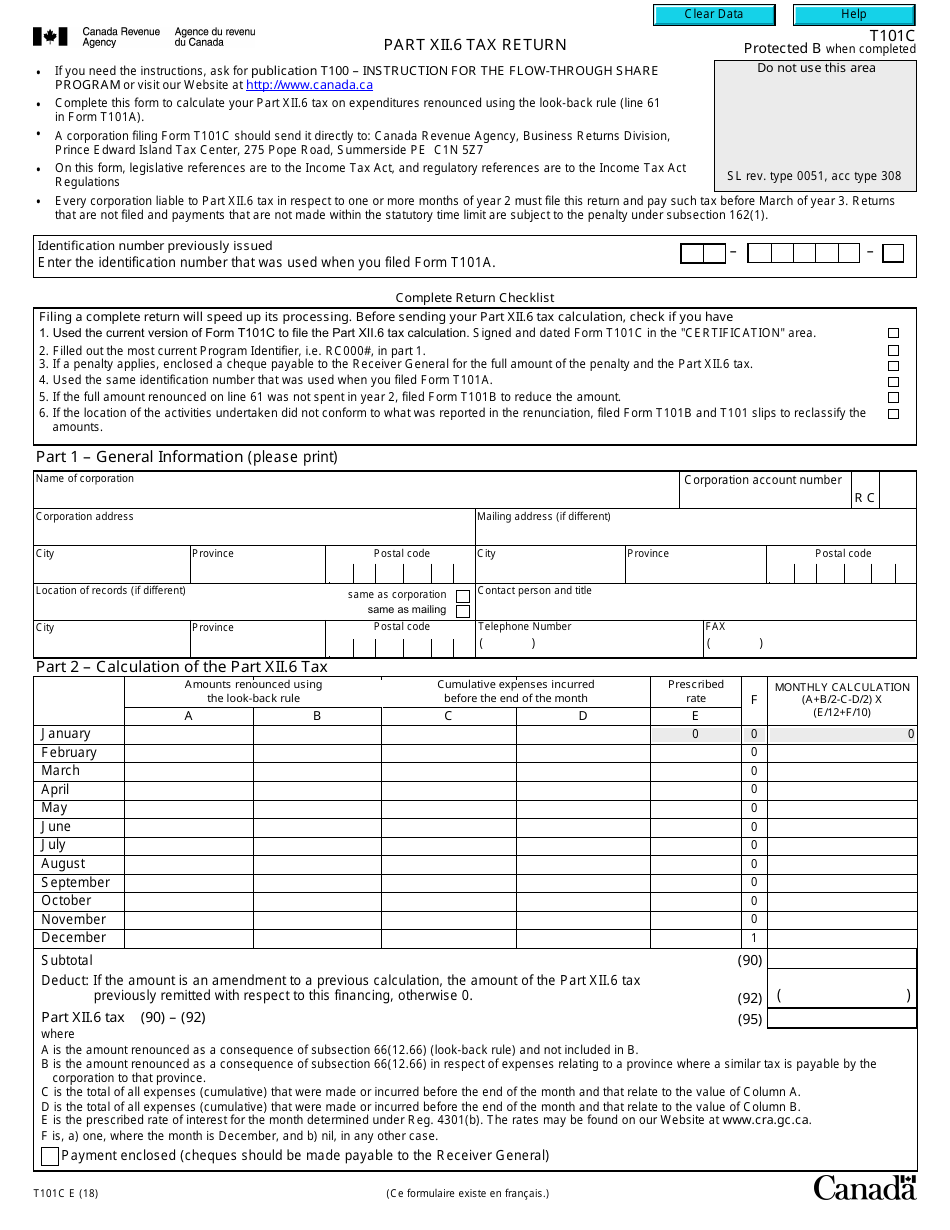

Form T101C Fill Out, Sign Online and Download Fillable PDF, Canada

This document provides a comprehensive list of key federal tax forms for. What is a t1 general income tax form? You can get an income tax package online or by mail. The primary document you need to file. Turbotax® provides all the tax forms you need, based on your tax situation.

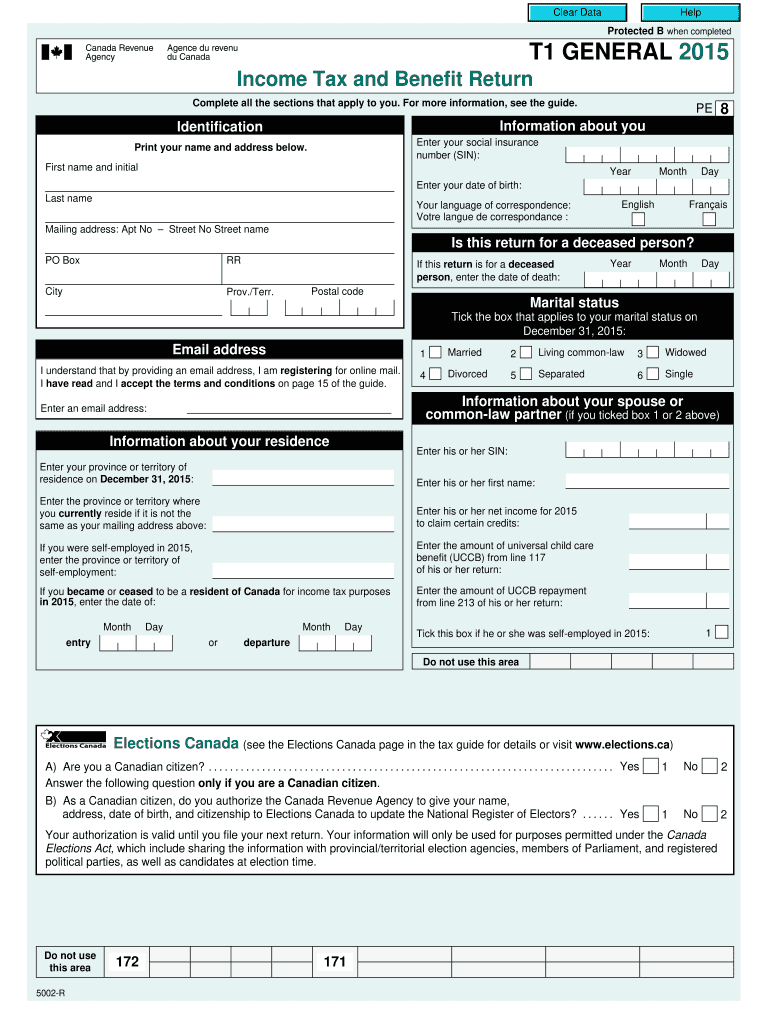

Tax Programs Canada 2024 Sasha Jacklyn

As an employee, you complete this form if you have a new employer or payer and. What is a t1 general income tax form? This document provides a comprehensive list of key federal tax forms for. The primary document you need to file. Turbotax® provides all the tax forms you need, based on your tax situation.

First Name And Initials Tax Form Canada Fill Out And Sign Online Dochub

You can get an income tax package online or by mail. As an employee, you complete this form if you have a new employer or payer and. This document provides a comprehensive list of key federal tax forms for. What is a t1 general income tax form? Turbotax® provides all the tax forms you need, based on your tax situation.

2012 Form Canada T2 Corporation Tax Return Fill Online

As an employee, you complete this form if you have a new employer or payer and. The primary document you need to file. This document provides a comprehensive list of key federal tax forms for. You can get an income tax package online or by mail. What is a t1 general income tax form?

Canada Federal Tax Form 2024 Denna Felecia

Turbotax® provides all the tax forms you need, based on your tax situation. What is a t1 general income tax form? You can get an income tax package online or by mail. This document provides a comprehensive list of key federal tax forms for. As an employee, you complete this form if you have a new employer or payer and.

You Can Get An Income Tax Package Online Or By Mail.

Turbotax® provides all the tax forms you need, based on your tax situation. What is a t1 general income tax form? The primary document you need to file. This document provides a comprehensive list of key federal tax forms for.