Can Tax Debt Be Discharged In Bankruptcy

Can Tax Debt Be Discharged In Bankruptcy - When conditions are in the best interest of both the. You must meet three requirements for the u.s. Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. Paying your tax debt in full is the best way to get rid of a federal tax lien. Bankruptcy court to discharge your tax debt. Essentially, this rule requires that the irs. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors.

Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. When conditions are in the best interest of both the. Bankruptcy court to discharge your tax debt. Essentially, this rule requires that the irs. Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. Paying your tax debt in full is the best way to get rid of a federal tax lien. You must meet three requirements for the u.s.

When conditions are in the best interest of both the. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. Essentially, this rule requires that the irs. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. Paying your tax debt in full is the best way to get rid of a federal tax lien. You must meet three requirements for the u.s. Bankruptcy court to discharge your tax debt. Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities.

What Debt Can't Be Discharged Through Bankruptcy? DebtStoppers

Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. Bankruptcy court to discharge your tax debt. When conditions are in the best interest of both the. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. When determining whether they can.

Can Tax Debt be discharged in Bankruptcy YouTube

Bankruptcy court to discharge your tax debt. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. Essentially, this rule requires that the irs. Paying your tax debt in full is the best way to get rid of a federal tax lien. When conditions are in the best interest of both the.

What Debt Can’t Be Discharged When Filing for Bankruptcy? (2024)

You must meet three requirements for the u.s. Bankruptcy court to discharge your tax debt. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. Essentially, this rule requires that the irs. When conditions are in the best interest of both the.

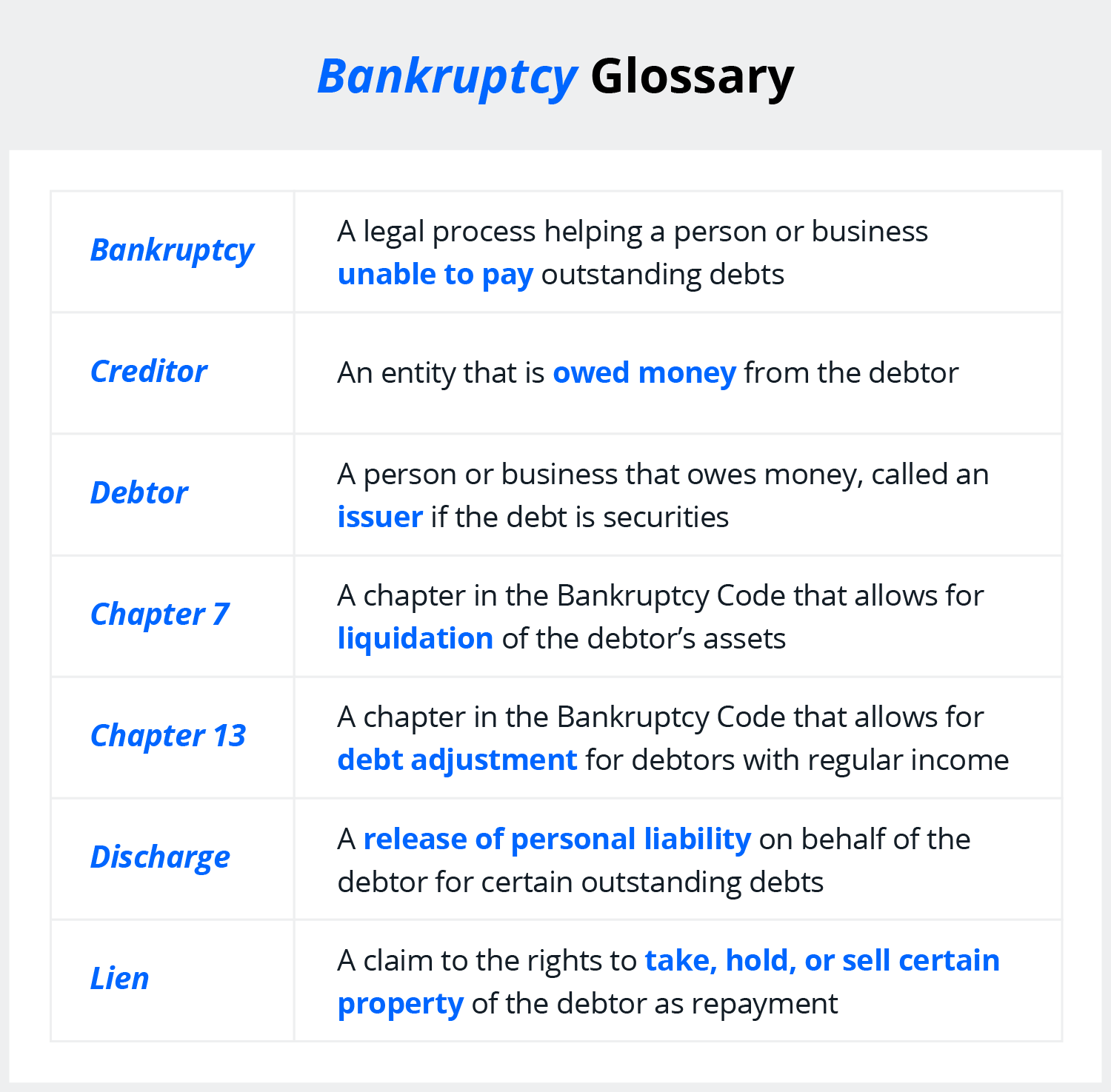

What Is a Bankruptcy Discharge?

Bankruptcy court to discharge your tax debt. When conditions are in the best interest of both the. You must meet three requirements for the u.s. Essentially, this rule requires that the irs. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan.

Can Tax Debt Be Smart Tax Strategies Call Us (888) 8883649

Paying your tax debt in full is the best way to get rid of a federal tax lien. Essentially, this rule requires that the irs. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities. Bankruptcy court to discharge your tax.

Can I Qualify for IRS Debt in Bankruptcy? OakTree Law

When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. Essentially, this rule requires that the irs. When conditions are in the best interest of both the. Irs may keep payments, and time.

Chapter 13 Bankruptcy Can IRS Debt be Discharged? Internal Revenue

Bankruptcy court to discharge your tax debt. When conditions are in the best interest of both the. Essentially, this rule requires that the irs. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. Irs may keep payments, and time in bankruptcy extends time to collect remaining tax liabilities.

What Debt Can't Be Discharged Through Bankruptcy? DebtStoppers

You must meet three requirements for the u.s. When conditions are in the best interest of both the. Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. Irs may keep payments, and.

Bankruptcy Explained Types And How It Works, 57 OFF

Bankruptcy court to discharge your tax debt. Paying your tax debt in full is the best way to get rid of a federal tax lien. When conditions are in the best interest of both the. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors. Essentially, this rule requires that the irs.

Can Tax Debt Be Inherited Smart Tax Strategies Call Us (888) 8883649

You must meet three requirements for the u.s. Essentially, this rule requires that the irs. Bankruptcy court to discharge your tax debt. Paying your tax debt in full is the best way to get rid of a federal tax lien. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors.

Bankruptcy Court To Discharge Your Tax Debt.

Some filers can discharge or wipe out tax debts in chapter 13 bankruptcy but most pay it through the chapter 13 repayment plan. Paying your tax debt in full is the best way to get rid of a federal tax lien. Essentially, this rule requires that the irs. When conditions are in the best interest of both the.

Irs May Keep Payments, And Time In Bankruptcy Extends Time To Collect Remaining Tax Liabilities.

You must meet three requirements for the u.s. When determining whether they can discharge tax debt, bankruptcy filers must consider many factors.

:max_bytes(150000):strip_icc()/what-debt-cannot-be-discharged-when-filing-bankruptcy.asp_final-1787b61755b34e1799fdde71e9b8508f.png)

:max_bytes(150000):strip_icc()/bankruptcy-discharge-what-is-it-and-when-does-it-happen-8eafb0f711c24a048d4854a82cdb5f70.png)