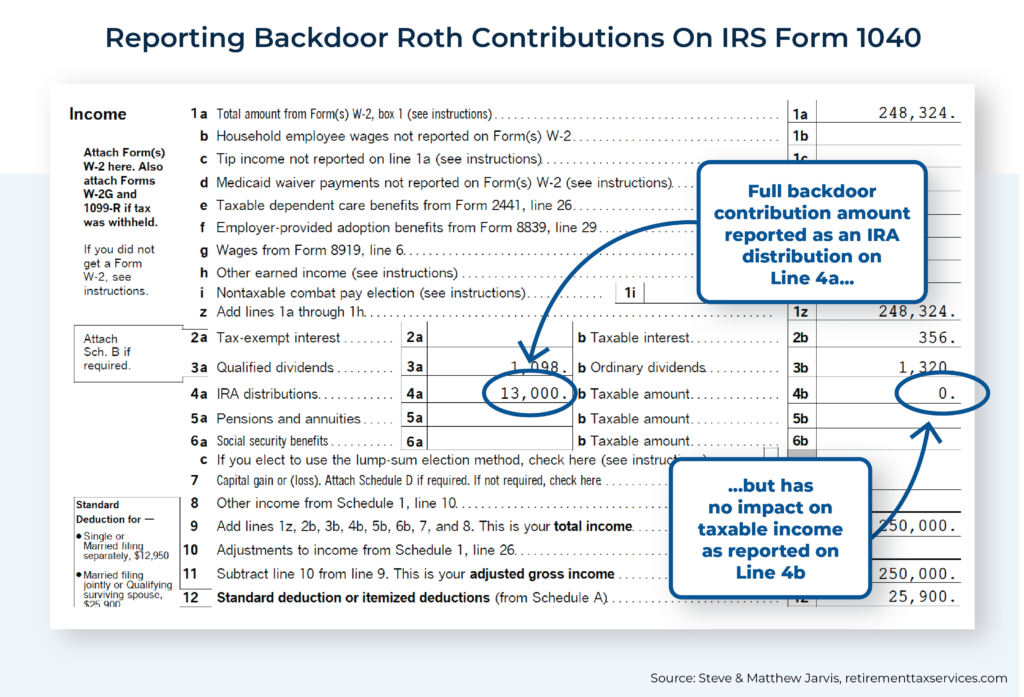

Backdoor Roth Ira Tax Form

Backdoor Roth Ira Tax Form - A backdoor roth ira allows you to get around income limits by converting a traditional ira. Accurate tax reporting is critical for a backdoor roth ira conversion. Learn how to use a backdoor roth ira to fund a roth ira despite income limits and how to.

Learn how to use a backdoor roth ira to fund a roth ira despite income limits and how to. Accurate tax reporting is critical for a backdoor roth ira conversion. A backdoor roth ira allows you to get around income limits by converting a traditional ira.

Accurate tax reporting is critical for a backdoor roth ira conversion. A backdoor roth ira allows you to get around income limits by converting a traditional ira. Learn how to use a backdoor roth ira to fund a roth ira despite income limits and how to.

How should form 8606 / backdoor Roth IRA look? My CPA’s software left

Accurate tax reporting is critical for a backdoor roth ira conversion. A backdoor roth ira allows you to get around income limits by converting a traditional ira. Learn how to use a backdoor roth ira to fund a roth ira despite income limits and how to.

LATE Backdoor ROTH IRA Tax Tutorial TurboTax & Form 8606 walkthrough

A backdoor roth ira allows you to get around income limits by converting a traditional ira. Accurate tax reporting is critical for a backdoor roth ira conversion. Learn how to use a backdoor roth ira to fund a roth ira despite income limits and how to.

5 Essential Backdoor Roth IRA Facts That You Need to Know Tony Florida

Learn how to use a backdoor roth ira to fund a roth ira despite income limits and how to. Accurate tax reporting is critical for a backdoor roth ira conversion. A backdoor roth ira allows you to get around income limits by converting a traditional ira.

“Backdoor” Roth IRAs The Life Financial Group, Inc.

A backdoor roth ira allows you to get around income limits by converting a traditional ira. Learn how to use a backdoor roth ira to fund a roth ira despite income limits and how to. Accurate tax reporting is critical for a backdoor roth ira conversion.

Understanding the Backdoor Roth IRA HMA CPA, PS

Accurate tax reporting is critical for a backdoor roth ira conversion. Learn how to use a backdoor roth ira to fund a roth ira despite income limits and how to. A backdoor roth ira allows you to get around income limits by converting a traditional ira.

Unlocking the Benefits of a Backdoor Roth IRA A TaxSaving Strategy

Accurate tax reporting is critical for a backdoor roth ira conversion. A backdoor roth ira allows you to get around income limits by converting a traditional ira. Learn how to use a backdoor roth ira to fund a roth ira despite income limits and how to.

Backdoor Roth IRA Tax LOOPHOLE you should know! Inflation Protection

Accurate tax reporting is critical for a backdoor roth ira conversion. A backdoor roth ira allows you to get around income limits by converting a traditional ira. Learn how to use a backdoor roth ira to fund a roth ira despite income limits and how to.

Effective Backdoor Roth Strategy Rules, IRS Form 8606

Learn how to use a backdoor roth ira to fund a roth ira despite income limits and how to. Accurate tax reporting is critical for a backdoor roth ira conversion. A backdoor roth ira allows you to get around income limits by converting a traditional ira.

Traditional IRAs vs Roth IRAs Comparison 1st National Bank

Accurate tax reporting is critical for a backdoor roth ira conversion. Learn how to use a backdoor roth ira to fund a roth ira despite income limits and how to. A backdoor roth ira allows you to get around income limits by converting a traditional ira.

Backdoor Roth IRA Definition and Guide (2024) Biglaw Investor

A backdoor roth ira allows you to get around income limits by converting a traditional ira. Learn how to use a backdoor roth ira to fund a roth ira despite income limits and how to. Accurate tax reporting is critical for a backdoor roth ira conversion.

A Backdoor Roth Ira Allows You To Get Around Income Limits By Converting A Traditional Ira.

Accurate tax reporting is critical for a backdoor roth ira conversion. Learn how to use a backdoor roth ira to fund a roth ira despite income limits and how to.