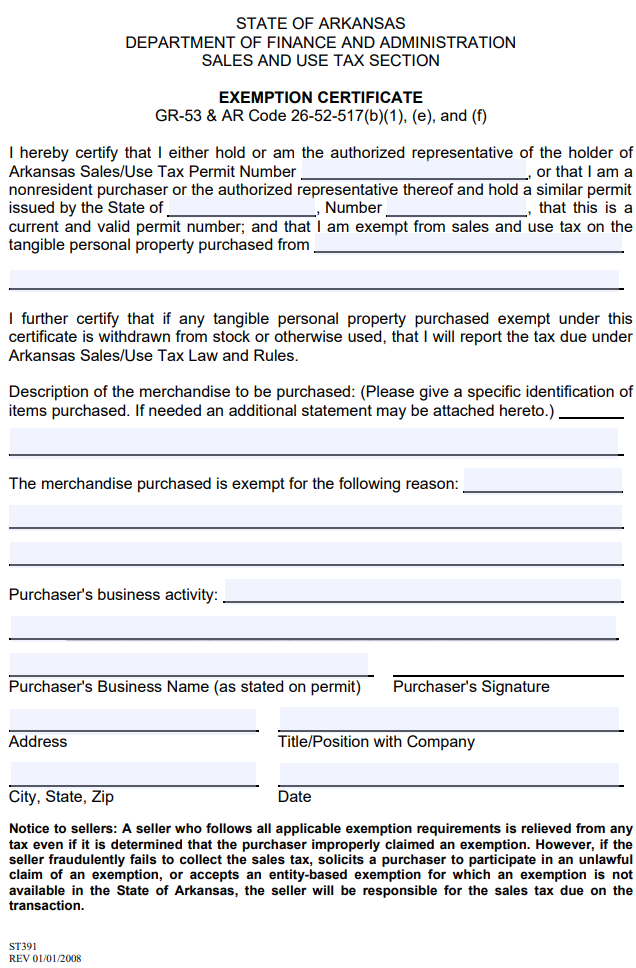

Arkansas Sales Tax Exempt Form

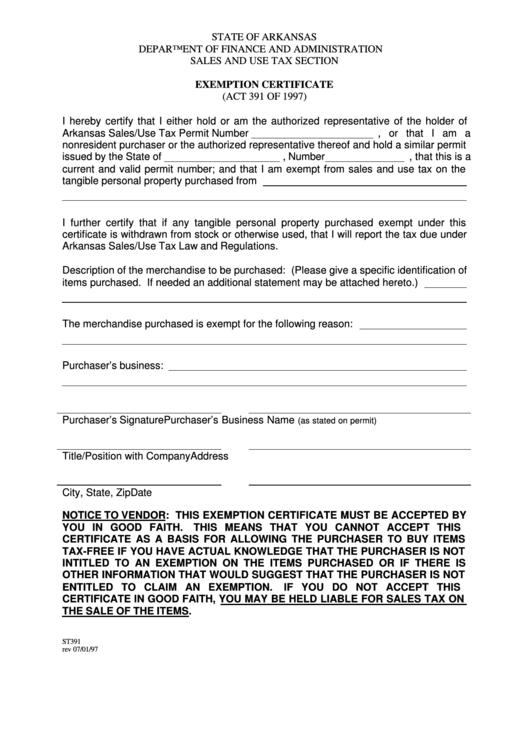

Arkansas Sales Tax Exempt Form - The arkansas sales and use tax section does not send blank arkansas excise. The merchandise purchased is exempt for the following reason: Arkansas sales/use tax law and regulations. Provide the id number to claim exemption from sales tax that is required by the taxing state. Description of the merchandise to be.

Description of the merchandise to be. Provide the id number to claim exemption from sales tax that is required by the taxing state. The merchandise purchased is exempt for the following reason: The arkansas sales and use tax section does not send blank arkansas excise. Arkansas sales/use tax law and regulations.

The arkansas sales and use tax section does not send blank arkansas excise. The merchandise purchased is exempt for the following reason: Arkansas sales/use tax law and regulations. Description of the merchandise to be. Provide the id number to claim exemption from sales tax that is required by the taxing state.

What is Exempt from Sales Tax in Arkansas A Comprehensive Guide

Description of the merchandise to be. Arkansas sales/use tax law and regulations. The arkansas sales and use tax section does not send blank arkansas excise. The merchandise purchased is exempt for the following reason: Provide the id number to claim exemption from sales tax that is required by the taxing state.

Ultimate Arkansas Sales Tax Guide Zamp

Arkansas sales/use tax law and regulations. Description of the merchandise to be. Provide the id number to claim exemption from sales tax that is required by the taxing state. The merchandise purchased is exempt for the following reason: The arkansas sales and use tax section does not send blank arkansas excise.

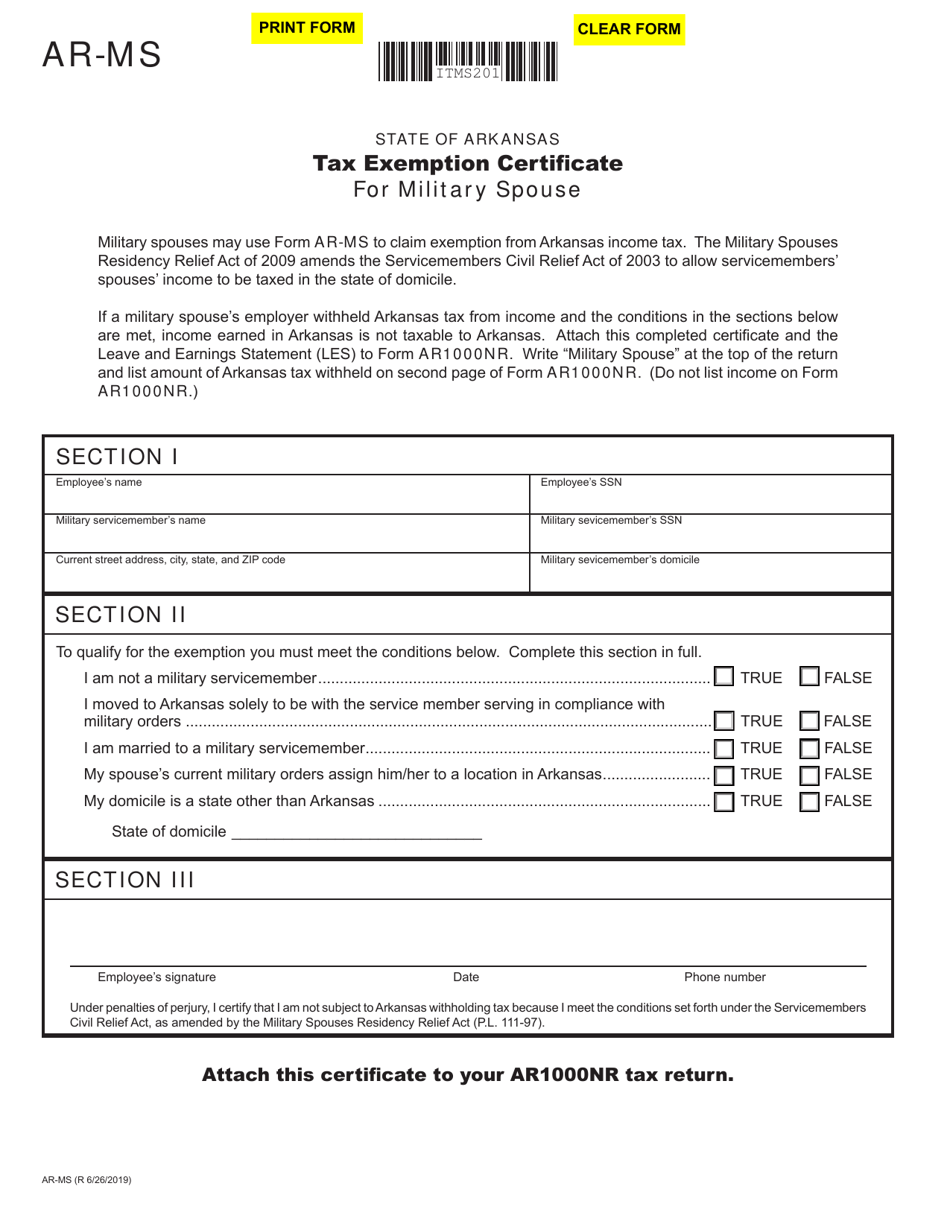

Form ARMS Download Fillable PDF or Fill Online Tax Exemption

Provide the id number to claim exemption from sales tax that is required by the taxing state. The merchandise purchased is exempt for the following reason: The arkansas sales and use tax section does not send blank arkansas excise. Description of the merchandise to be. Arkansas sales/use tax law and regulations.

Arkansas Sales Tax Exempt Form

The arkansas sales and use tax section does not send blank arkansas excise. Provide the id number to claim exemption from sales tax that is required by the taxing state. Arkansas sales/use tax law and regulations. The merchandise purchased is exempt for the following reason: Description of the merchandise to be.

Arkansas State Tax Exemption Form

Arkansas sales/use tax law and regulations. Provide the id number to claim exemption from sales tax that is required by the taxing state. Description of the merchandise to be. The merchandise purchased is exempt for the following reason: The arkansas sales and use tax section does not send blank arkansas excise.

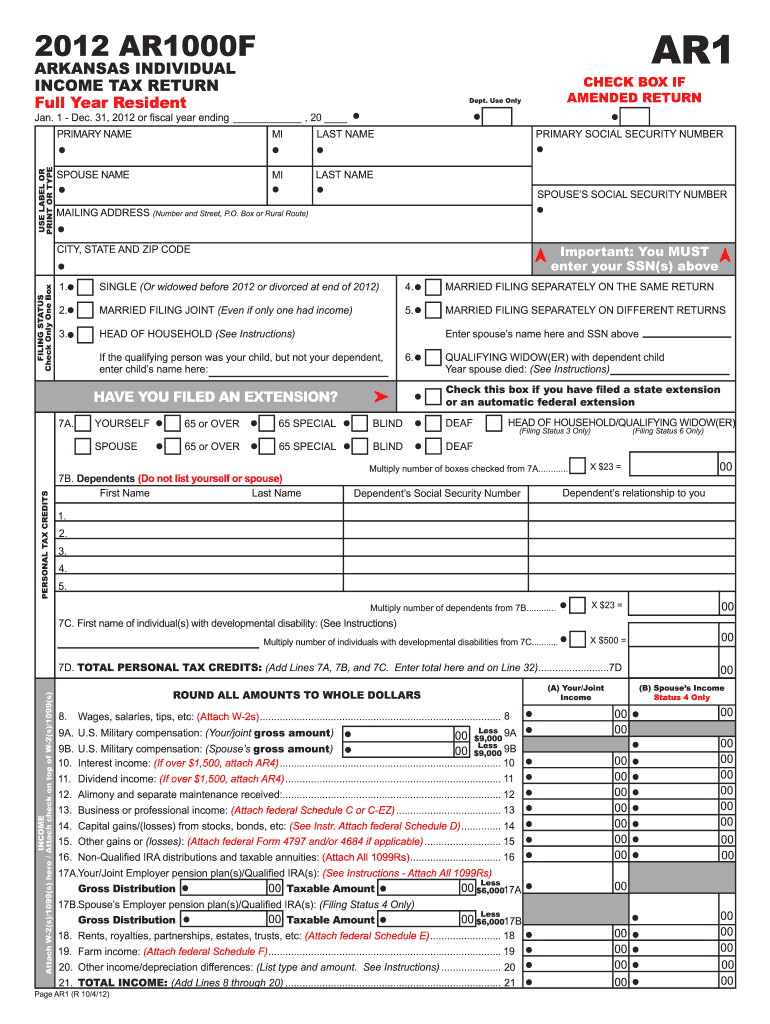

2012 arkansas form tax Fill out & sign online DocHub

Provide the id number to claim exemption from sales tax that is required by the taxing state. Arkansas sales/use tax law and regulations. The arkansas sales and use tax section does not send blank arkansas excise. The merchandise purchased is exempt for the following reason: Description of the merchandise to be.

Sales Tax Exemption Form For Arkansas Pdf

Arkansas sales/use tax law and regulations. The arkansas sales and use tax section does not send blank arkansas excise. Provide the id number to claim exemption from sales tax that is required by the taxing state. The merchandise purchased is exempt for the following reason: Description of the merchandise to be.

Arkansas Withholding Form 2023 Printable Forms Free Online

Description of the merchandise to be. The merchandise purchased is exempt for the following reason: Provide the id number to claim exemption from sales tax that is required by the taxing state. Arkansas sales/use tax law and regulations. The arkansas sales and use tax section does not send blank arkansas excise.

Arkansas Farm Sales Tax Exemption Form

Provide the id number to claim exemption from sales tax that is required by the taxing state. Description of the merchandise to be. The arkansas sales and use tax section does not send blank arkansas excise. Arkansas sales/use tax law and regulations. The merchandise purchased is exempt for the following reason:

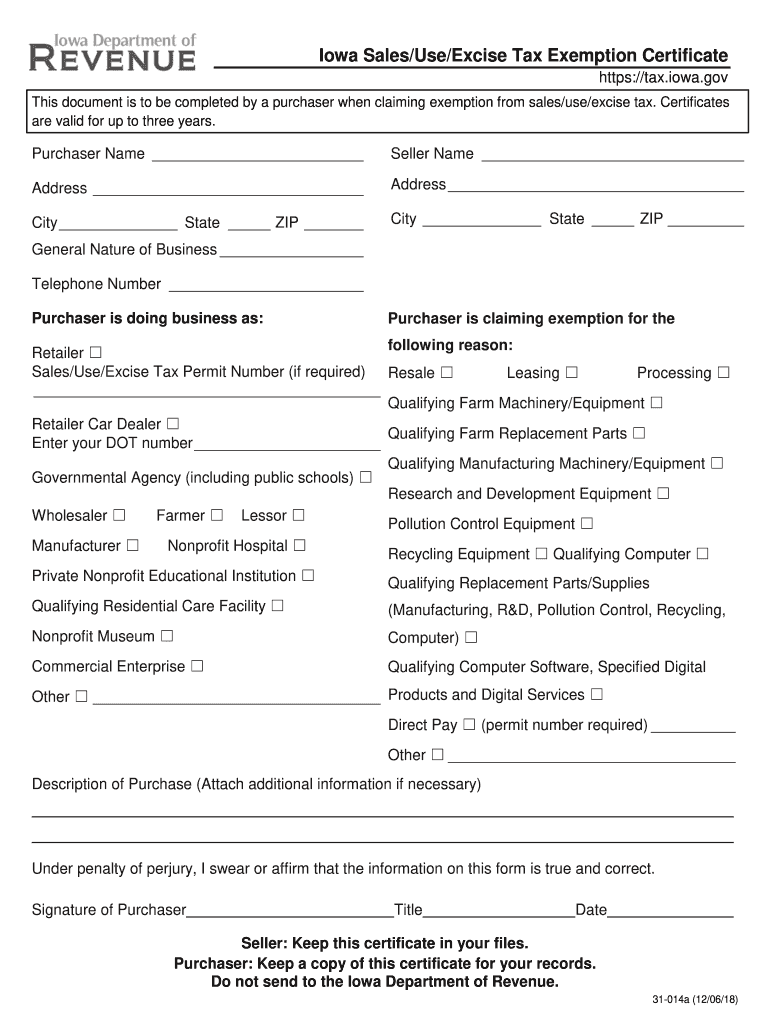

How To Get A Sales Tax Exemption Certificate In Colorado

Arkansas sales/use tax law and regulations. Provide the id number to claim exemption from sales tax that is required by the taxing state. The merchandise purchased is exempt for the following reason: Description of the merchandise to be. The arkansas sales and use tax section does not send blank arkansas excise.

The Arkansas Sales And Use Tax Section Does Not Send Blank Arkansas Excise.

The merchandise purchased is exempt for the following reason: Arkansas sales/use tax law and regulations. Provide the id number to claim exemption from sales tax that is required by the taxing state. Description of the merchandise to be.