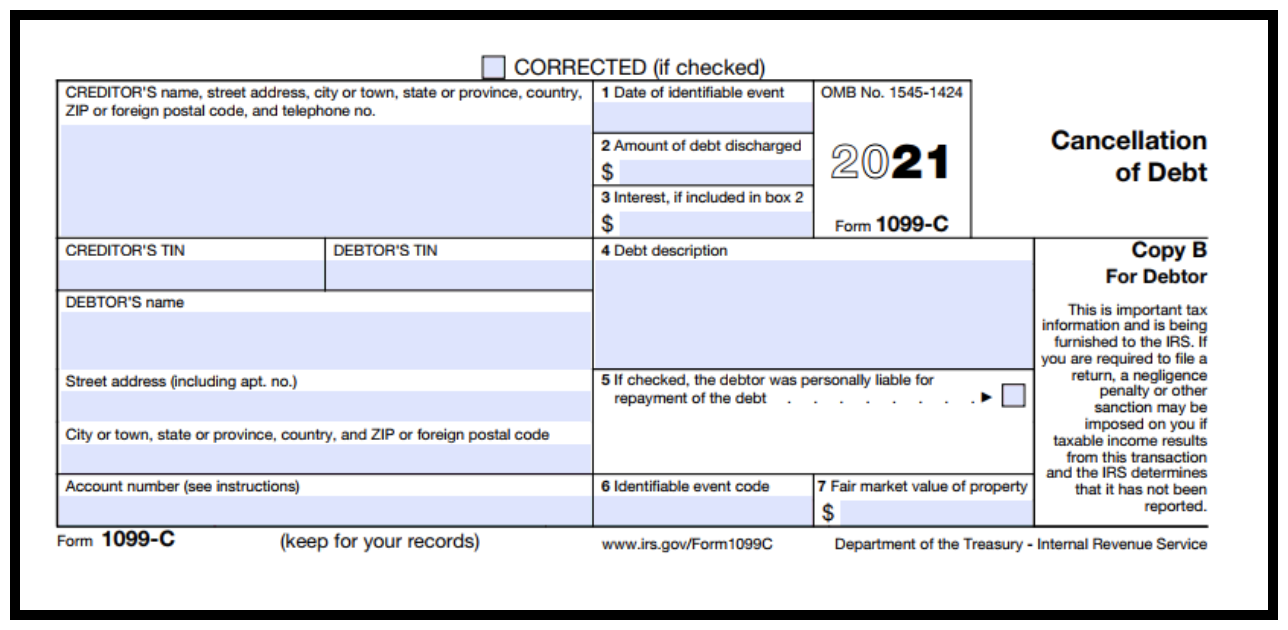

Amount Of Debt Discharged Meaning 1099-C

Amount Of Debt Discharged Meaning 1099-C - In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable.

In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable.

In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable.

What Are The Dischargeable Debts In Bankruptcy?

In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable.

1099 A . Debt Discharge how I do it in conjunction with 1099 C

In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable.

IRS Form 982 Instructions Discharge of Indebtedness

In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable.

Other Spring 2018, lamc. ppt download

In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable.

Debt Discharge What it is, How it Works

In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable.

TheHealthCity Vaginal Discharge What Different Colours Of Discharge

In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable.

1099 C Cancellation of Debt Explained YouTube

In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable.

1099 C. DEBT CANCELLATIONExplained YouTube

In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable.

How can I pay the taxes for the shown on my 1099C?

In general, if your debt is canceled, forgiven, or discharged for less than the amount owed, the amount of the canceled debt is taxable.

:max_bytes(150000):strip_icc()/finalnew-cd2c2367ef8f4fcdaa1e9218acf86c9d.jpg)