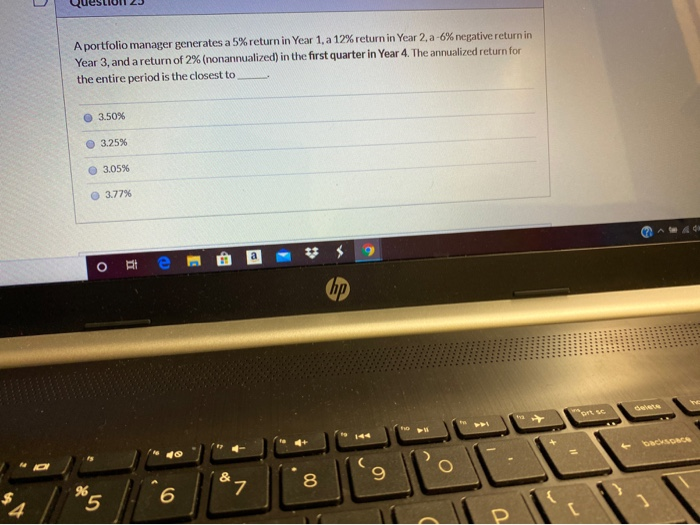

A Portfolio Manager Generates A 5 Return In Year 1

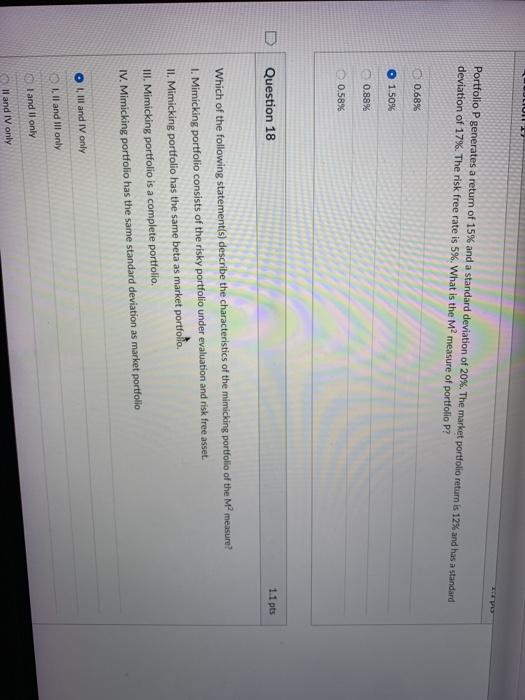

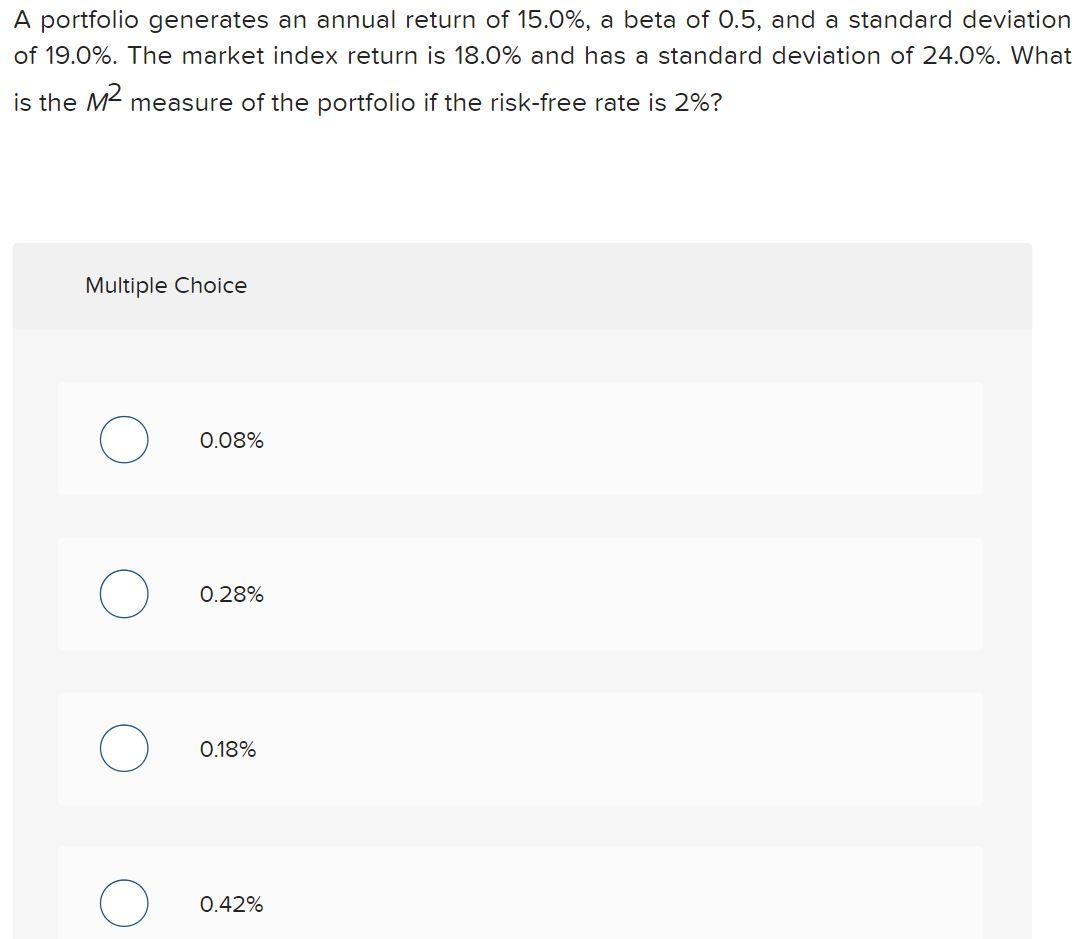

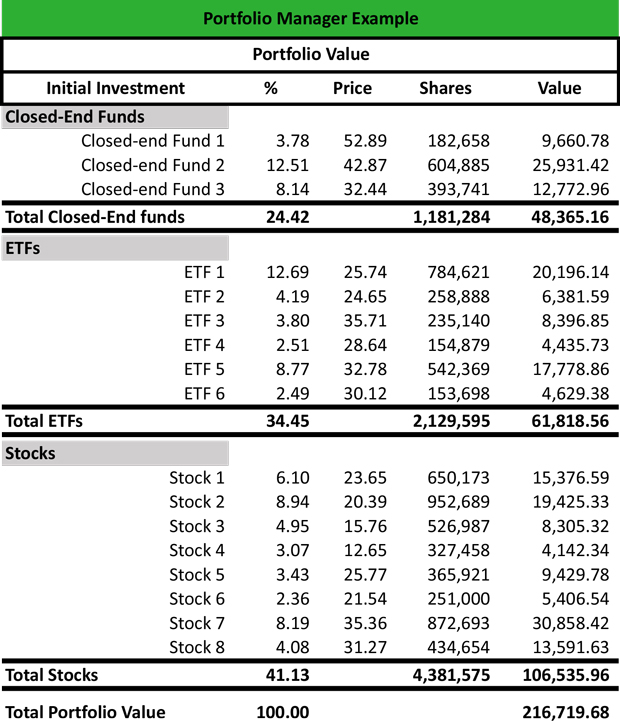

A Portfolio Manager Generates A 5 Return In Year 1 - Adrian, a portfolio manager, generates a return of 14% when the benchmark returns. Portfolio manager generates 6% return in year 1, 0% return in year 2, negative 4% return in year. To calculate this, apply the geometric mean to evaluate the total return over the entire period. A portfolio manager generates a 5% return in. There’s just one step to solve this. 37.a portfolio manager generates a 5% return in 2008, a 12% return in 2009, a negative 6% return.

Adrian, a portfolio manager, generates a return of 14% when the benchmark returns. To calculate this, apply the geometric mean to evaluate the total return over the entire period. A portfolio manager generates a 5% return in. Portfolio manager generates 6% return in year 1, 0% return in year 2, negative 4% return in year. 37.a portfolio manager generates a 5% return in 2008, a 12% return in 2009, a negative 6% return. There’s just one step to solve this.

There’s just one step to solve this. 37.a portfolio manager generates a 5% return in 2008, a 12% return in 2009, a negative 6% return. To calculate this, apply the geometric mean to evaluate the total return over the entire period. Adrian, a portfolio manager, generates a return of 14% when the benchmark returns. Portfolio manager generates 6% return in year 1, 0% return in year 2, negative 4% return in year. A portfolio manager generates a 5% return in.

Solved Portfolio P generates a return of 15 and a standard

37.a portfolio manager generates a 5% return in 2008, a 12% return in 2009, a negative 6% return. A portfolio manager generates a 5% return in. There’s just one step to solve this. To calculate this, apply the geometric mean to evaluate the total return over the entire period. Portfolio manager generates 6% return in year 1, 0% return in.

How to Calculate Annualized Portfolio Return 8 Steps wikiHow

To calculate this, apply the geometric mean to evaluate the total return over the entire period. Portfolio manager generates 6% return in year 1, 0% return in year 2, negative 4% return in year. A portfolio manager generates a 5% return in. There’s just one step to solve this. Adrian, a portfolio manager, generates a return of 14% when the.

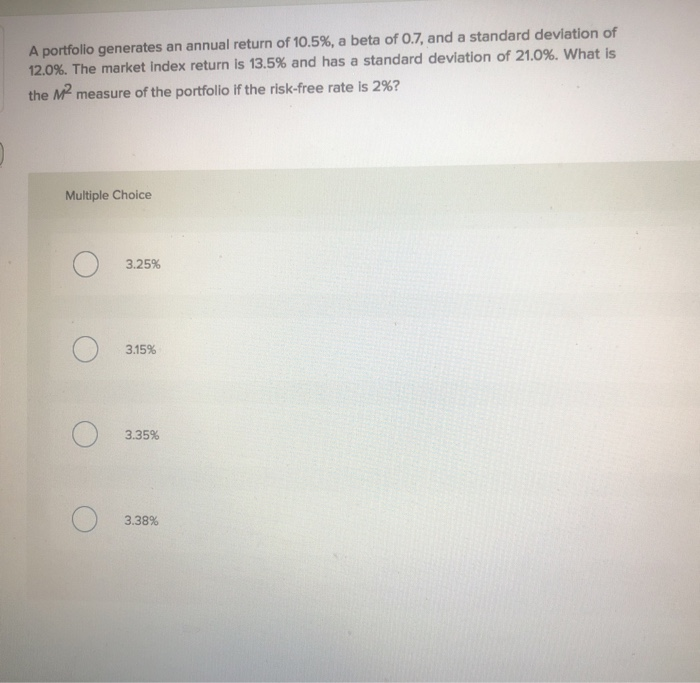

Solved A portfolio generates an annual return of 15.0, a

To calculate this, apply the geometric mean to evaluate the total return over the entire period. There’s just one step to solve this. Adrian, a portfolio manager, generates a return of 14% when the benchmark returns. A portfolio manager generates a 5% return in. 37.a portfolio manager generates a 5% return in 2008, a 12% return in 2009, a negative.

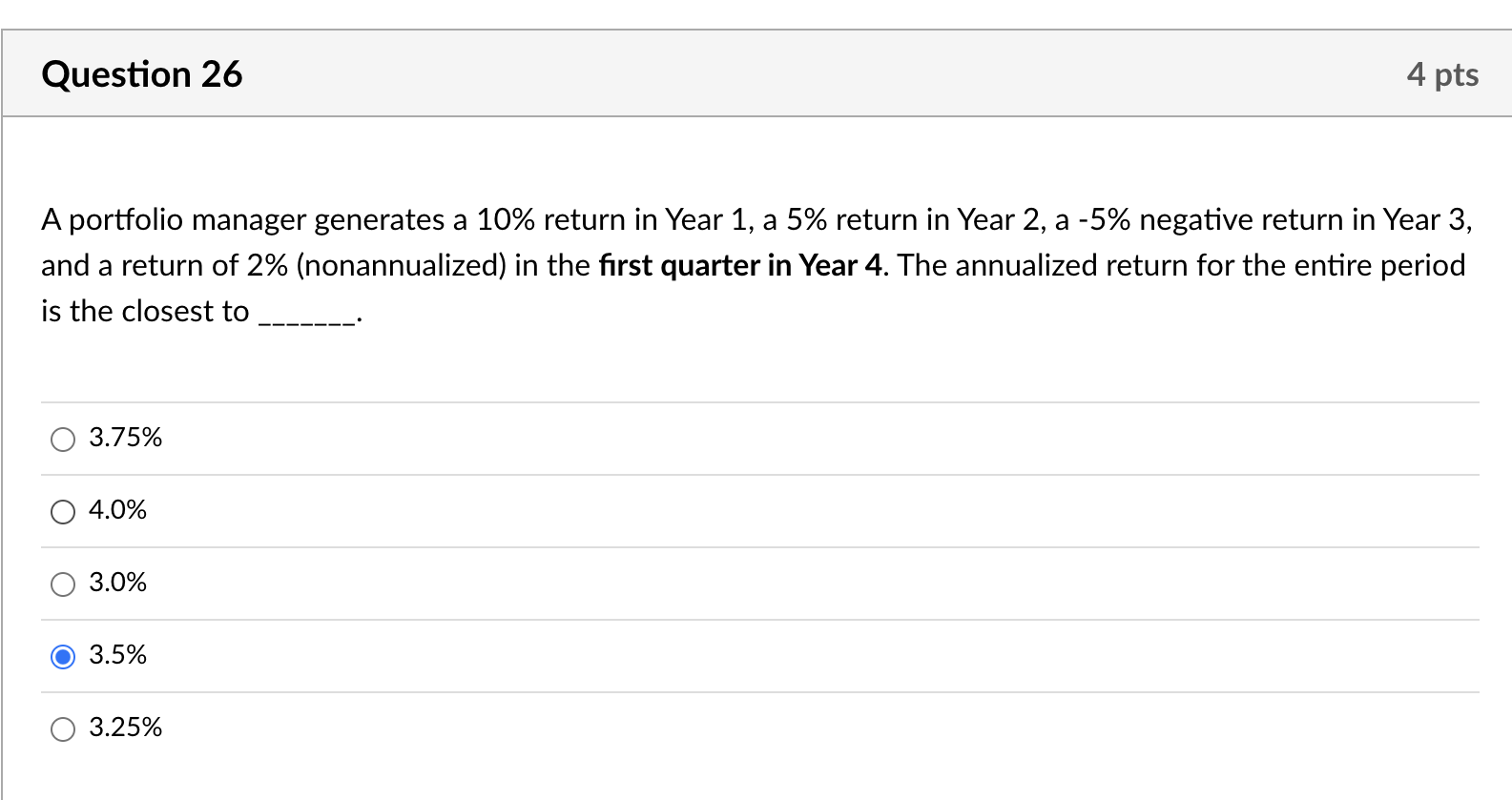

Solved A portfolio manager generates a 5 return in Year 1,

Adrian, a portfolio manager, generates a return of 14% when the benchmark returns. Portfolio manager generates 6% return in year 1, 0% return in year 2, negative 4% return in year. A portfolio manager generates a 5% return in. There’s just one step to solve this. To calculate this, apply the geometric mean to evaluate the total return over the.

What is a Portfolio Manager? Definition Meaning Example

37.a portfolio manager generates a 5% return in 2008, a 12% return in 2009, a negative 6% return. To calculate this, apply the geometric mean to evaluate the total return over the entire period. A portfolio manager generates a 5% return in. Adrian, a portfolio manager, generates a return of 14% when the benchmark returns. Portfolio manager generates 6% return.

How to Calculate Annualized Portfolio Return 8 Steps

Adrian, a portfolio manager, generates a return of 14% when the benchmark returns. Portfolio manager generates 6% return in year 1, 0% return in year 2, negative 4% return in year. To calculate this, apply the geometric mean to evaluate the total return over the entire period. 37.a portfolio manager generates a 5% return in 2008, a 12% return in.

Solved A portfolio generates an annual return of 10.5, a

There’s just one step to solve this. 37.a portfolio manager generates a 5% return in 2008, a 12% return in 2009, a negative 6% return. To calculate this, apply the geometric mean to evaluate the total return over the entire period. Portfolio manager generates 6% return in year 1, 0% return in year 2, negative 4% return in year. A.

Solved A portfolio manager generates a 10 return in Year 1,

There’s just one step to solve this. To calculate this, apply the geometric mean to evaluate the total return over the entire period. A portfolio manager generates a 5% return in. 37.a portfolio manager generates a 5% return in 2008, a 12% return in 2009, a negative 6% return. Adrian, a portfolio manager, generates a return of 14% when the.

Portfolio Return Formula Calculator (Examples With Excel Template)

Portfolio manager generates 6% return in year 1, 0% return in year 2, negative 4% return in year. To calculate this, apply the geometric mean to evaluate the total return over the entire period. 37.a portfolio manager generates a 5% return in 2008, a 12% return in 2009, a negative 6% return. Adrian, a portfolio manager, generates a return of.

A portfolio generates a total return of 15 . The tax rates on interest

Portfolio manager generates 6% return in year 1, 0% return in year 2, negative 4% return in year. Adrian, a portfolio manager, generates a return of 14% when the benchmark returns. There’s just one step to solve this. 37.a portfolio manager generates a 5% return in 2008, a 12% return in 2009, a negative 6% return. To calculate this, apply.

To Calculate This, Apply The Geometric Mean To Evaluate The Total Return Over The Entire Period.

37.a portfolio manager generates a 5% return in 2008, a 12% return in 2009, a negative 6% return. A portfolio manager generates a 5% return in. Adrian, a portfolio manager, generates a return of 14% when the benchmark returns. Portfolio manager generates 6% return in year 1, 0% return in year 2, negative 4% return in year.